Indicators on Hard Money Atlanta You Should Know

Wiki Article

Little Known Questions About Hard Money Atlanta.

Table of Contents7 Easy Facts About Hard Money Atlanta Shown10 Easy Facts About Hard Money Atlanta ExplainedThe Ultimate Guide To Hard Money AtlantaWhat Does Hard Money Atlanta Do?The Ultimate Guide To Hard Money Atlanta

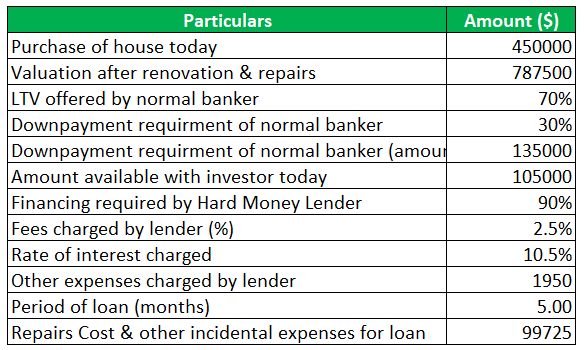

, are short-term financing tools that genuine estate investors can make use of to finance a financial investment task.There are 2 main downsides to consider: Tough cash finances are hassle-free, yet investors pay a rate for obtaining this method. The price can be up to 10 percentage factors higher than for a standard car loan.

Not known Details About Hard Money Atlanta

Again, lenders might allow investors a bit of leeway here.

Difficult cash loans are a good fit for well-off investors who require to get financing for a financial investment home rapidly, without any of the red tape that accompanies financial institution financing (hard money atlanta). When assessing difficult cash loan providers, pay attention to the costs, rate of interest, and also funding terms. If you finish up paying excessive for a hard cash funding or cut the repayment period as well short, that can influence exactly how profitable your actual estate endeavor remains in the future.

If you're seeking to purchase a residence to flip or as a rental building, it can be testing to get a standard home mortgage - hard money atlanta. If your credit rating isn't where a typical lending institution would certainly like it or you need cash money quicker than a loan provider is able to supply it, you can be out of good luck.

8 Simple Techniques For Hard Money Atlanta

Difficult cash financings are temporary secured finances that utilize the residential property you're acquiring as collateral. You will not discover one from your bank: Difficult money loans are provided by different lenders such as specific financiers and private business, who normally ignore sub-par credit report and various other economic factors and rather base their decision on the property to be collateralized.Difficult cash car loans give numerous advantages for consumers. These consist of: From beginning to complete, a hard money funding could take just a couple of days.

It's key to consider all the dangers they reveal. While difficult cash loans come with benefits, a customer needs to likewise consider the dangers. Amongst them are: Tough money loan providers commonly bill a higher rates of interest since they're thinking even more threat than a conventional lender would certainly. Once again, that's as a result of the risk that a tough cash loan provider is taking.

The Buzz on Hard Money Atlanta

Every one of that includes up to indicate that a hard cash car loan can be a costly method to borrow cash. hard money atlanta. Deciding whether to obtain a difficult money funding depends in large component on your circumstance. Regardless, be sure you weigh the threats and also the prices before you join the dotted line for a difficult cash lending.You definitely do not desire to shed the funding's security due to the fact that you weren't able to maintain up with the monthly settlements. Along with shedding the property you place forward as security, click for more back-pedaling a difficult cash loan can cause significant credit rating injury. Both of these outcomes will certainly leave you even worse off monetarily than you remained in the first placeand may make it a lot harder to obtain once more.

6 Simple Techniques For Hard Money Atlanta

It is necessary to take into account aspects such as the lender's credibility and interest prices. You could ask a trusted real estate representative or a fellow home fin for suggestions. As soon as you've toenailed down the ideal difficult money loan provider, be prepared to: Create the down settlement, which generally is heftier than the down repayment for a typical mortgage Collect the needed paperwork, such as proof of income Potentially work with a lawyer to look at the regards to the loan after you've been approved Map out a method for paying off the lending Simply as with any kind of funding, review the advantages and disadvantages of a difficult cash financing prior to you commit to loaning.Despite what kind of loan you select, it's most likely a good concept to check your free credit history and also cost-free debt report with Experian to see where your funds click this site stand.

(or "personal cash financing") what's the very first thing that goes with your mind? In previous years, some negative apples tainted the hard money lending industry when a few predatory lending institutions were attempting to "loan-to-own", giving extremely high-risk lendings to customers making use of real estate as security and also planning to foreclose on the homes.

Report this wiki page